Insight Sources: Broadcast insights estimated by Podchaser.

Back to All Agencies

PHD USA | Agency Profile, Contacts, AOR, Client Relationships

Service: media buying & planning

- Main Telephone

- (212) 894-6600

Primary Address

220 East 42nd Street

New York ,

NY

10017

USA

PHD USA Contacts

Contacts (5/69)

| Name | Title | State | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Peter C. | Executive Director- Operations | NY | ||||||||||||

|

Sample of Related Brands

***********

|

||||||||||||||

| Will L. | Director, Commerce | NY | ||||||||||||

| Kimberly F. | Supervisor, Strategy | NY | ||||||||||||

| Dylan C. | Manager, Media Investment | NY | ||||||||||||

| Jon A. | Chief Innovation Officer & President | NY | ||||||||||||

WinmoEdge

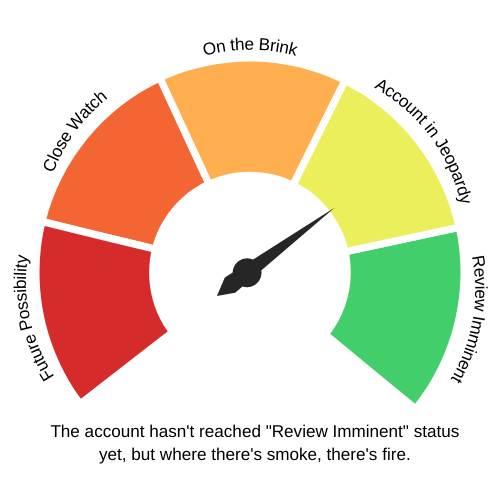

Popeyes wraps up creative review (Score 71)

Sales lead: Contact this company now to offer ad space & inquire about agency opportunities.

- McKinney as its creative AOR, effective April 2023.

- The agency is responsible for creative development/production, brand strategy, and influencers.

- Its first creative work is expected to debut in late spring.

- This concludes the review we recently told you about.

- McKinney served as interim lead creative agency during the review.

- GUT was the incumbent creative AOR for about three years.

Popeye's target demographic: Gen-Z & millennials with a male skew

The company will likely:

- Review other agency relationships

- Release new creative/launch a campaign (expected in Q2)

- Revise creative strategy

Broadcast insights (TV ad creative spend, effectiveness, impressions, and performance)

- YTD spend: Popeyes spent approximately $27.5m on national TV ads YTD, close to the $27.2m spent in this channel during the same time period of 2022.

- 2021-2022 spend: Full-year spend dropped slightly (3%) from $105m in 2021 to $101.6m in 2022.

- Ad programming: It placed ads during programming such as NFL Football, NBA Basketball, The Big Bang Theory, Friends, and The First 48.

Digital and social insights (digital ad spend, effectiveness, impressions, and performance)

- YTD spend: Popeyes spent around $4.3m on digital display ads YTD, a 54% increase from $2.8m spent in this channel during the same time period of 2022.

- YTD data: 562m impressions via Instagram (49%), Facebook (39%), and YouTube (12%).

- 2021-2022 spend: Full-year spend fell by 26% from $21.1m in 2021 to $15.6m in 2022.

- Ad location: It placed 100% of these ads directly onto sites such as instagram.com, facebook.com, and youtube.com.

Additional channel insights

- Vivvix: Popeyes also utilizes OOH, print, radio, and local broadcast.

- Top podcasts sponsored: The Dan Le Batard Show with Stugotz, The NewsWorthy, The John Batchelor Show, and Skip and Shannon: Undisputed.

Agency analysis:

- Opportunity: Agency reviews commonly follow one another, so reach out now to secure top priority.

- Current roster:

- PHD USA: media buying & planning

- Alison Brod Public Relations: PR AOR