Prospecting Alert: Top 10 TV Advertisers

Upfronts might be over, but if you sell TV advertising, prospecting is a year-round job. TV continues to be a big hit among audiences and advertisers alike. U.S. TV ad spending was up by 3.1% in 2018, finishing the year at $72.4 billion, a trend that is likely to continue upward.

We’re breaking down the big guys – the top 10 TV advertisers with a minimum media spend of $200 million in the realm of Network TV. These brands are making significant investments, and often top Network players translate to top OTT spenders as well, so whatever delivery medium you represent, these are the behemoths to keep your eye on.

Not only are we listing top TV advertisers and their historical spend, we’re including top networks and top show data for the past 30 days, courtesy of our partnership with real-time TV measurement leader iSpot.tv, plus select opportunity alerts from our prospecting publication WinmoEdge.

This data, coupled with up-to-date client and agency decision-maker rosters, is what gives Winmo users a leg up on pitching and ultimately winning more TV revenue. Ready to take a look?

Here are the top 10 TV advertisers in no particular order:

1. Verizon Wireless, Inc

2018 Total Media Spend: $634.77 M

Network TV: $355.71 M

Company Revenue: $130.86 B

Location: Basking Ridge, NJ

BONUS: Notable Prospecting Trigger:

Reported in March, Verizon selected Hans Vestberg as the replacement CEO. The company also promoted Frank Boulben to SVP of consumer marketing and products, effective January.

Agency and Martech Opportunity: While none of these new personnel are a CMO, agency changes are still likely. Those with telecommunications experience should reach out. Competition will likely include Zenith Media, McCann New York, and The Community. Focus pitches on differentiating Verizon from competitors such as AT&T and Sprint. In addition, focus on bolstering Verizon Media, Verizon’s new 5G offerings, and it’s new subscription box.

Media Seller Opportunity: Verizon rolled out it’s “Real Good Reasons” campaign in March in an effort to showcase more diversity and appear more authentic. Focus on top spending periods Q1 and Q4. Verizon’s demographic consists of men age 35+, and main channels are out-of-home, experiential, print and radio.

Request a Demo for Access to Verizon Wireless, Inc Decision-Maker Contact Info

2. AT&T, Inc

2018 Total Media Spend: $1.04 B

Network TV: $451.96 B

Company Revenue: $170.76 B

Location: Dallas, TX

BONUS: Notable Prospecting Trigger:

Media Seller Opportunity: AT&T has a very wide deemographic, so those with high ROI, wide-reaching, omnichannel strategies should keep the brand on your radar. AT&T runs through all channels (TV, digital, social, earned, experiential, out-of-home, print, radio, cause marketing and sponsorships). Spend typically spikes in Q1 and Q4.

Reported in January, overall spend had seen declines, but will likely pick back up throughout the year. AT&T has plans to leverage content gained from its WarnerMedia acquisition, particularly with a new streaming service set to launch in Q4. Spend is also expected to ramp up for the 5G offering as well.

Request a Demo for Access to AT&T Decision-Maker Contact Info

3.Verizon Communications, Inc

2018 Total Media Spend: $938.51 M

Network TV: $440.55 M

Company Revenue: $130.86 M

Location: New York, NY

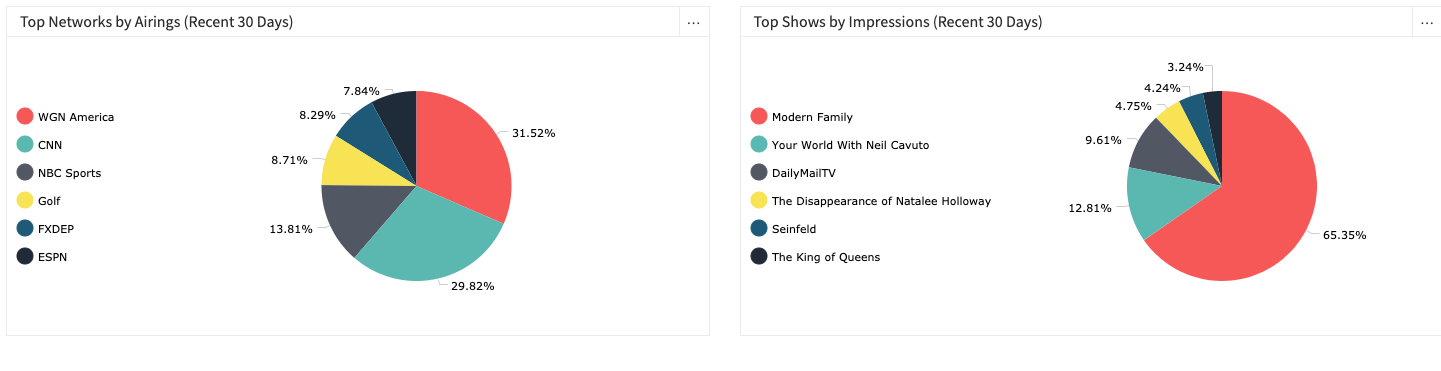

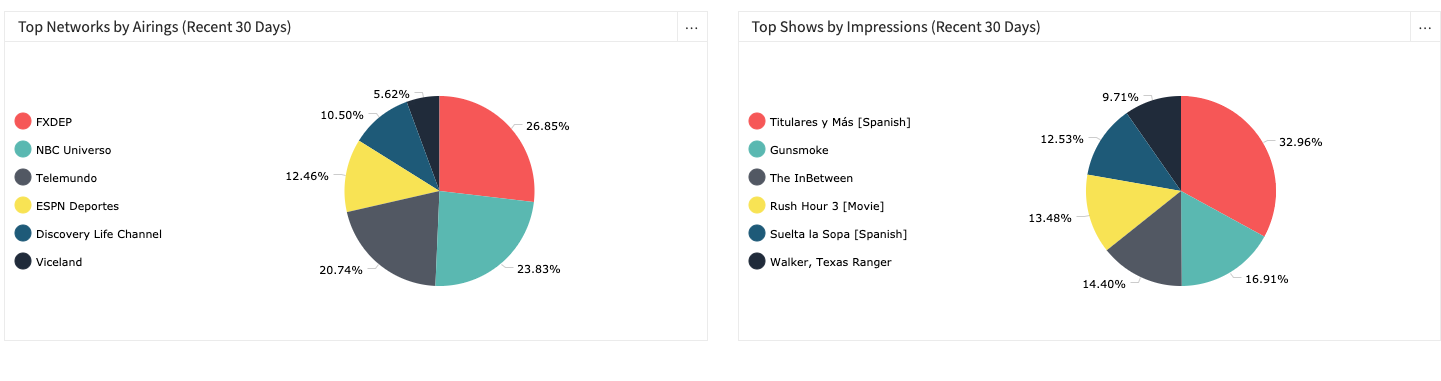

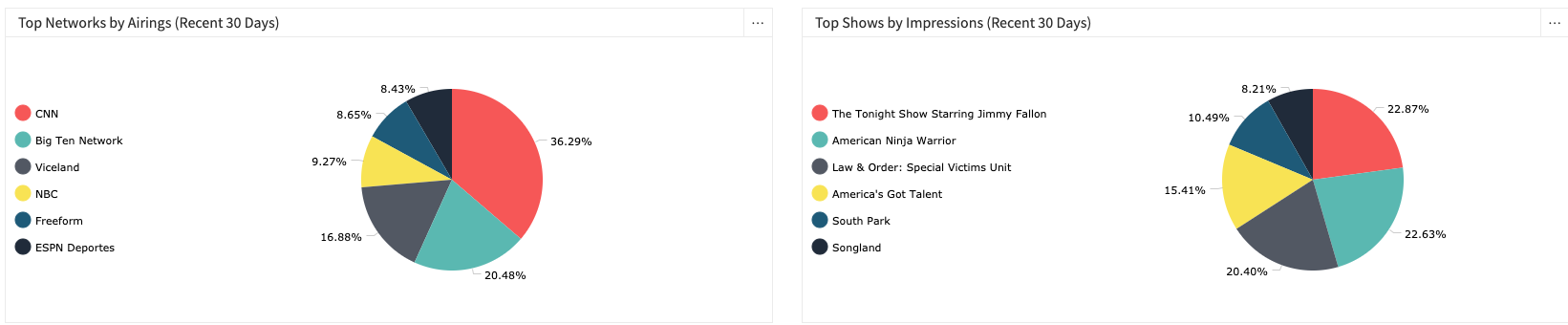

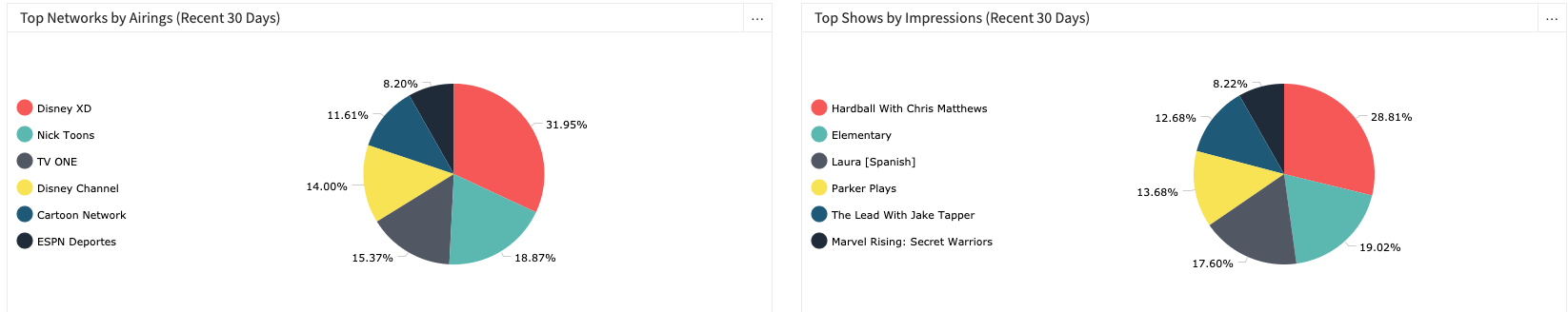

BONUS: Past 30-day iSpot TV detail:

Request a Demo for Access to Verizon Communications Decision-Maker Contact Info

Request a Demo for Access to Verizon Communications Decision-Maker Contact Info

4. T-Mobile USA

2018 Total Media Spend: $691.81 M

Network TV: $314.83 M

Company Revenue: $343.24 B

Location: Bellevue, WA

BONUS: Notable Prospecting Trigger:

Media Seller Opportunity: Top spending periods are typically Q1 and Q3-Q4. According to January reports, main focuses going into the year are “underpenetrated segments, such as new geographies, 55+, Military, and T-Mobile for Business” according to CEO John Legere.

In order to target those “underpenetrated segments,” T-Mobile has seen a decrease in TV spending in lieu of increases to digital, out-of-home, radio and print. Spend declines are expected to reverse themselves since T-Mobile started the year with several new hires in order to bolster their marketing efforts.

Agency and Martech Opportunity: Media has been out of Blue 449 since 1998, public relations has been out of Porter Novellie since 2001, and digital has been out of Publicis Hawkeye since 2015. With these relationships far past agency tenure (3-4 years), reach out to new personnel to secure potential work.

Request a Demo for Access to T-Mobile Decision-Maker Info

5. McDonald’s Corporation

2018 Total Media Spend: $610.71 M

Network TV: $257.25 M

Company Revenue: $21.02 M

Location: Chicago, IL

BONUS: Notable Prospecting Trigger:

McDonald’s announced that global CMO Silvia Lagnado will depart in October to pursue opportunities elsewhere. She will not be replaced, but the chain did just promote Colin Mitchell to global marketing SVP. He will take over some of her responsibilities including global marketing, insights, and menu innovation. The rest of Lagnado’s duties such as brand development, media, merchandising and customer relationship management will likely be split between the regional CMOs.

Agency and Martech Opportunity: With these major shifts as well as lower-level personnel hires, there’s a possibility for agency changes within the next 12-18 months. Agency and martech readers with QSR experience in particular are encouraged to reach out. Focus pitches on assisting with recent spend shifts and keeping McDonald’s top-of-mind among competitors Wendy’s, Burger King, and Arby’s.

Media Seller Opportunity: McDonald’s has been spending more on local marketing recently, and is currently still in the middle of a local media review. Local sellers are encouraged to reach out with this new focus, and keep in mind strategy may differ based on region but overall national focus will remain. The chain focuses on a millennial and Gen-Z demographic, making new technology, new menu items, expanded delivery, and increased personalization high priority.

Request a Demo for Access to McDonald’s Decision-Maker Contact Info

6. Progressive Casualty Insurance Company

2018 Total Media Spend: $882.31 M

Network TV: $384.43 M

Company Revenue: $31.95 B

Location: Mayfield Village, OH

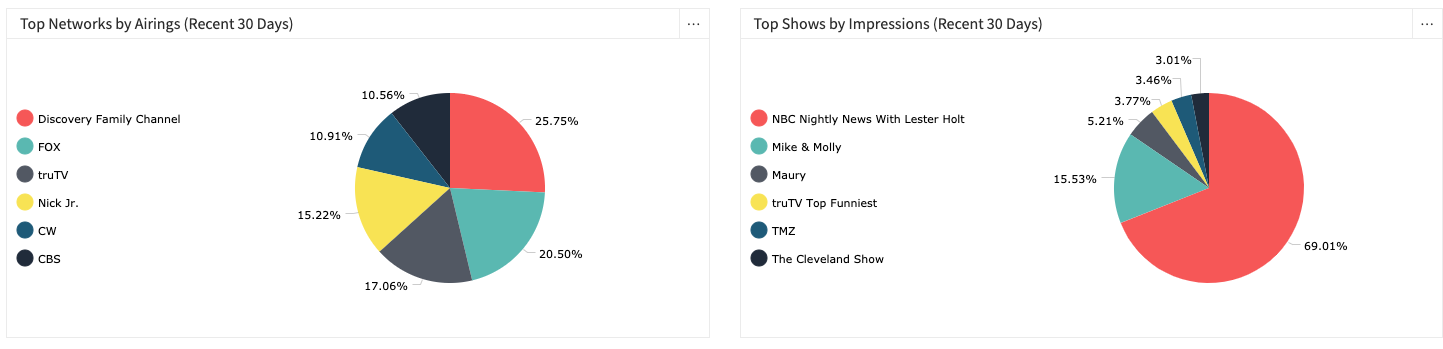

BONUS: Past 30-day iSpot TV detail:

Request a Demo for Access to Progressive Casualty Insurance Contact Info

7. GEICO Corporation

2018 Total Media Spend: $1.5 B

Network TV: $509.86 M

Company Revenue: $247.54 B

Location: Washington, DC

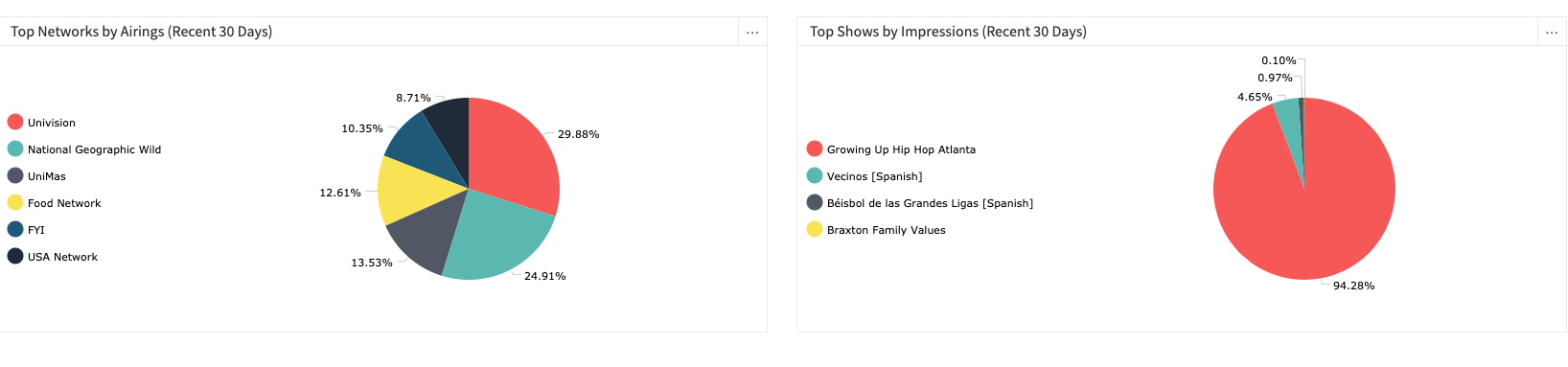

BONUS: Past 30-day iSpot TV detail:

Request a Demo for Access to GEICO CorporationDecision-Maker Contact Info

8. Walmart Stores, Inc

2018 Total Media Spend: $576.59 M

Network TV: $250.8 M

Company Revenue: $514.41 B

Location: Bentonville, AR

BONUS: Notable Prospecting Trigger:

Reported in May of this year, Walmart acquired adtech startup Polymorph Labs in order to help advertisers streamline the process for targeting audience segments. Walmart has been attempting to shake up its strategy and improve digital marketing efforts in order to better compete. The retailer also moved online ad sales and analytics in-house.

Media Seller Opportunity: Walmart has been increasing millennial and Gen-Z engagement with new campaigns, e-commerce offerings, and partnerships. These initiatives have resulted in spend increases that are expected to continue. With spend increases and new initiatives to secure revenue from, sellers should reach out. Spend is high throughout the year, but typically spikes during Q3 and Q4.

Agency and Martech Opportunity: CMO Barabara Messing and CCO Janey Whiteside have only been on the job for less than a year, so agency and martech readers are encouraged to reach out. Competition will include Haworth Marketing & Media, Golin, Swirl, Witeck Communications, and Publicis’s Walmart shop.

Request a Demo for Access to Walmart Decision-Maker Contact Info

Request a Demo for Access to Walmart Decision-Maker Contact Info

9. State Farm Insurance Companies

Total Media Spend: $514.75 M

Network TV: $231.38 M

Location: Bloomington, IL

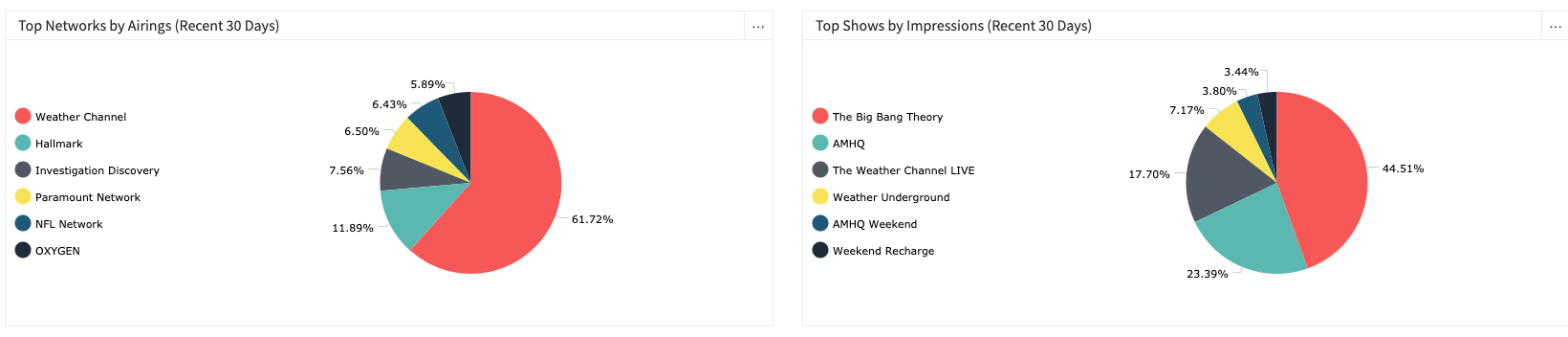

BONUS:Past 30-day iSpot TV detail:

Request a Demo for Access to State Farm Insurance Decision-Maker Info

10. Toyota Motor Sales, USA, Inc

2018 Total Media Spend: $312.04 M

Network TV: $208 M

Company Revenue: 280.7 B

Location: Plano, TX

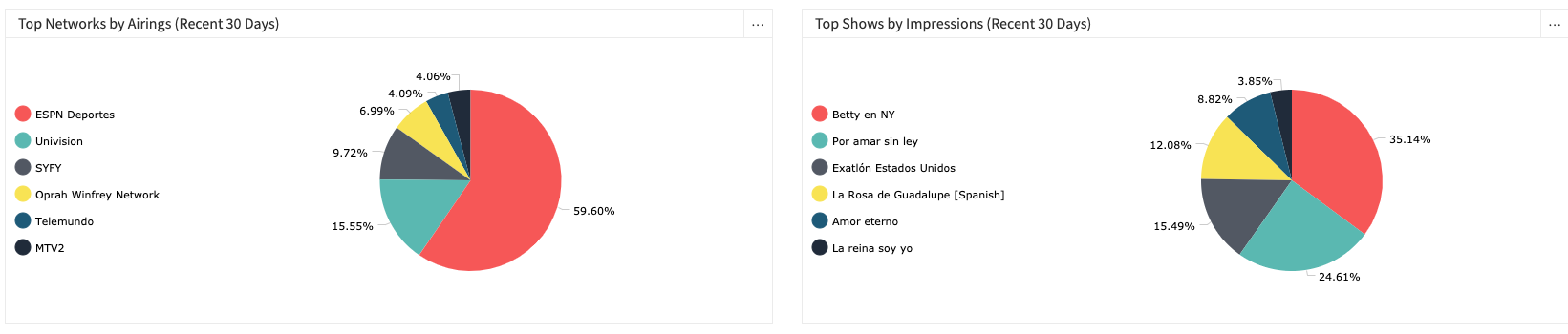

BONUS: Past 30-day iSpot TV detail:

Request a Demo for Access to Toyota Motor Sales Decision-Maker Contact Info

Want more insight on TV advertisers? Winmo allows you to search brands spending in Network TV, Cable TV, Spot TV, even Spanish Language stations, filter by planning or buying period timeframe, and navigate directly to the brand and agency teams responsible for their budgets. Request a Demo today to build your prospect list!