Social Media Ad Spend is Climbing: 10 Advertisers Behind the Spike

The end of Q2 and beginning of Q3 has been a highly emotional, and often volatile, time for advertisers, especially on social media.

Early June saw a dip in social media ad spend in the US, most notably in support of #BlackoutTuesday, a digital protest in response to the killing of George Floyd. However, spending returned to normal almost immediately with many brands using their platforms to align themselves with the Black Lives Matter movement and other social causes.

Then in July, more than 1,000 advertisers, including Unilever, Starbucks, and Coca-Cola, boycotted Facebook over hate speech, standing in solidarity with the campaign, Stop Hate For Profit.

Interestingly, the majority of these brands didn’t pause their social spending, but instead reallocated their budgets to other social media platforms, while many small-scale businesses continued their Facebook campaigns.

Video content has also experienced a renaissance in 2020, as the pandemic drove us all indoors with the time and resources to engage with more social video content, including those on Twitter and Facebook Live (and of course everyone’s favorite, TikTok, which must be saved).

Where’s the opportunity?

We recently began incorporating social spend data in Winmo, and as you can see from the 10 brands highlighted below, a major opportunity source lies in entertainment and CPG. Six months into COVID, we’re still operating with a quarantine mindset. Though restrictions are loosening across every state, life as we knew it is months, if not years, away.

We aren’t going to the movies, sporting events, or concerts, but we’re streaming them more than ever. Accordingly, HBO is capitalizing on its full name (Home Box Office for those who need a fun fact for your next team meeting) with the launch of HBO Max with a heavy focus on Facebook and video.

Equally important, FuboTV is anticipating an increase in subscription and advertising revenue along with more Q3 viewership thanks to the return of live, though fan-less, sports. The internet television service is also, of course, putting the majority of their ad dollars into Facebook, with Instagram a close second.

Household names Heineken, Oscar Meyer, and Heinz all make the list as the restaurant industry still struggles to safely reopen indoor dining, with the majority of Americans still choosing to cook at home. However, Buffalo Wild Wings is pushing both its takeout and dine in options, creating social campaigns around National Chicken Wing Day and introducing a house beer.

See what other brands are increasing social media ad spend:

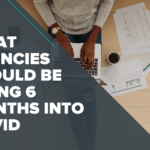

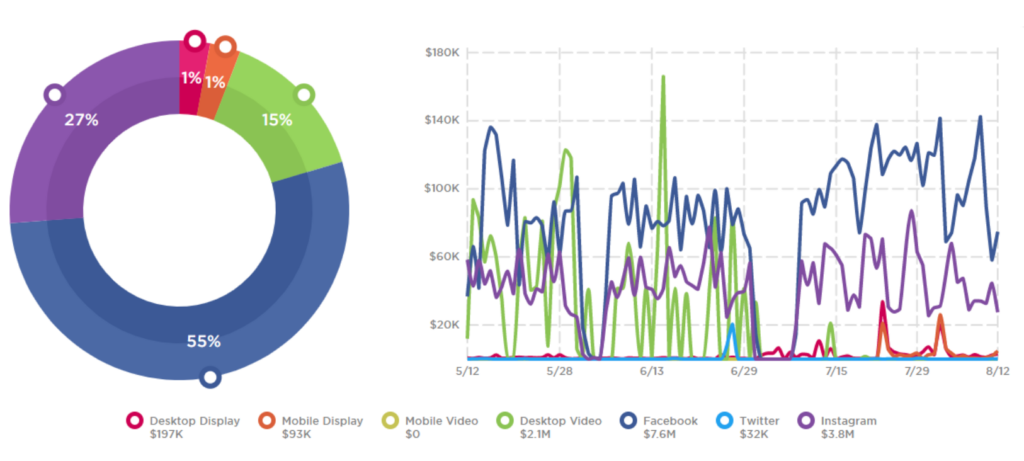

1) HBO

- 90-day Facebook spending: $44,059,200 → 5,888,031,400 impressions

- 90-day Instagram spending: $16,452,900 → 2,472,168,400 impressions

- 90-day Twitter spending: $2,440,400 → 577,790,900 impressions

90-day digital spending overview:

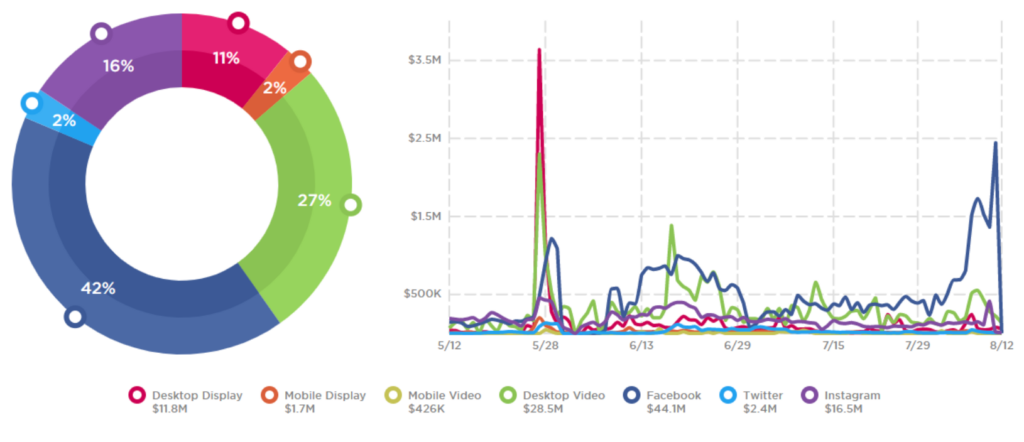

2) Heineken

- 90-day Facebook spending: $555,000 → 73,819,000 impressions

- 90-day Instagram spending: $450,200 → 67,631,200 impressions

- 90-day Twitter spending: $987,300 → 230,783,800 impressions

90-day digital spending overview:

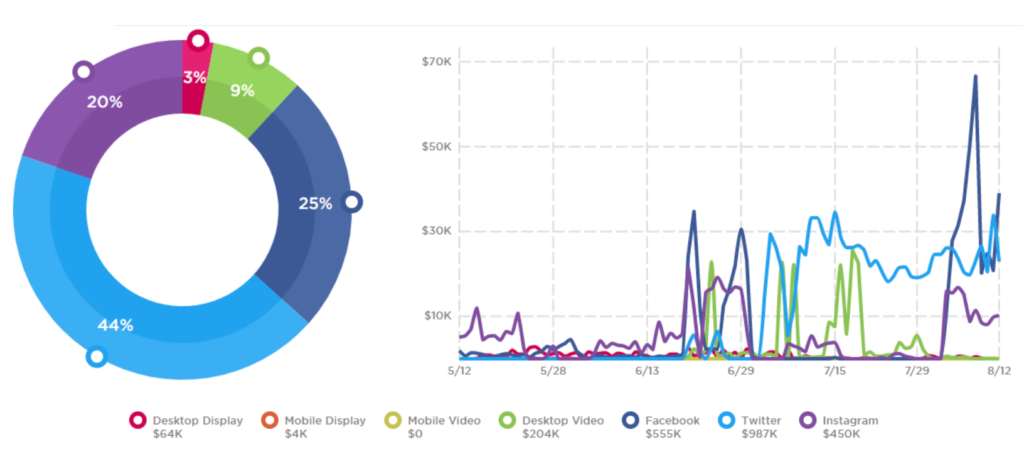

3) PediaSure

- 90-day Facebook spending: $698,700 → 93,038,000

- 90-day Instagram spending: $788,900 → 117,154,500

- 90-day Twitter spending: No spend

90-day digital spending overview:

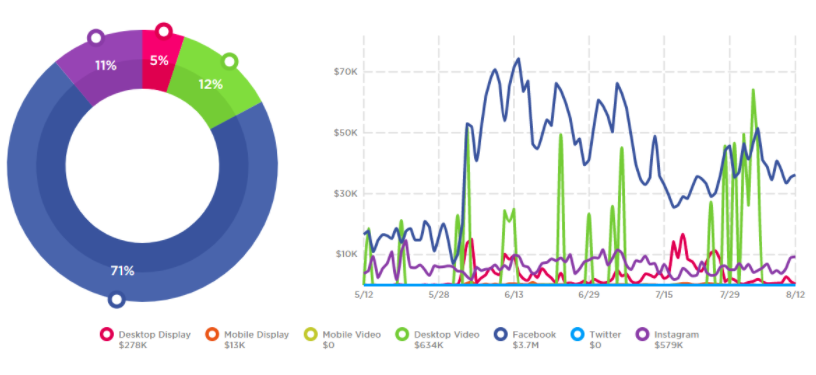

4) Buffalo Wild Wings

- 90-day Facebook spending: $7,590,300 → 1,015,374,600 impressions

- 90-day Instagram spending: $3,779,500 → 566,272,200 impressions

- 90-day Twitter spending: $31,900 → 7,604,600 impressions

90-day digital spending overview:

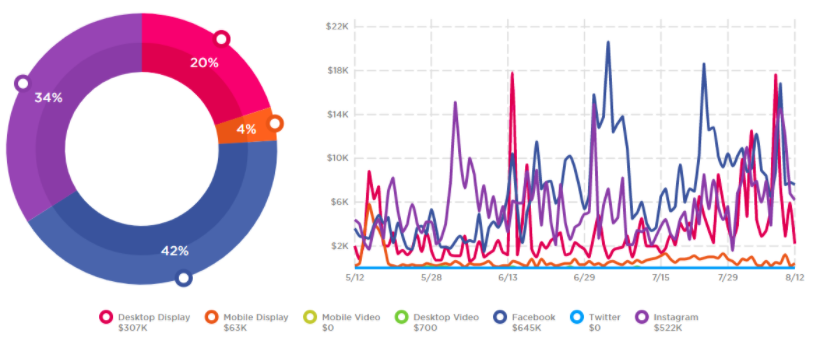

5) fuboTV

- 90-day Facebook spending: $645,300 → 85,629,000 impressions

- 90-day Instagram spending: $521,900 → 78,107,700 impressions

- 90-day Twitter spending: No spend

90-day digital spending overview:

6) Safe Life Defense

- 90-day Facebook spending: $3,660,900 → 490,141,600 impressions

- 90-day Instagram spending: $578,600 → 86,665,600 impressions

- 90-day Twitter spending: No spend

90-day digital spending overview:

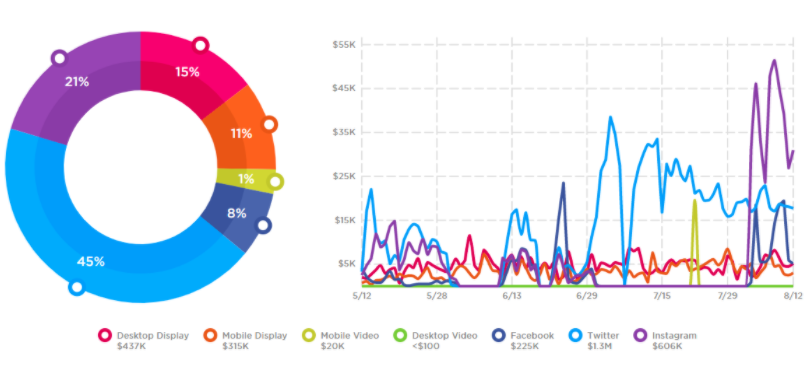

7) Oscar Mayer

- 90-day Facebook spending: $224,700 → 30,130,800 impressions

- 90-day Instagram spending: $606,400 → 90,447,100 impressions

- 90-day Twitter spending: $1,296,500 → 304,635,500 impressions

90-day digital spending overview:

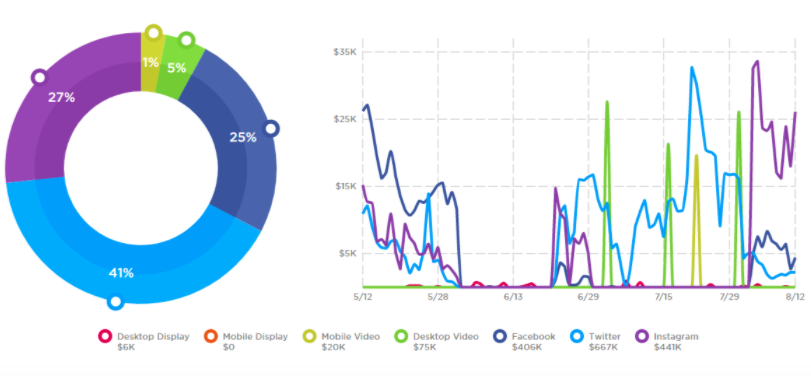

8) Heinz Ketchup

- 90-day Facebook spending: $406,400 → 55,388,800 impressions

- 90-day Instagram spending: $441,200 → 65,938,000 impressions

- 90-day Twitter spending: $666,800 → 156,886,500 impressions

90-day digital spending overview:

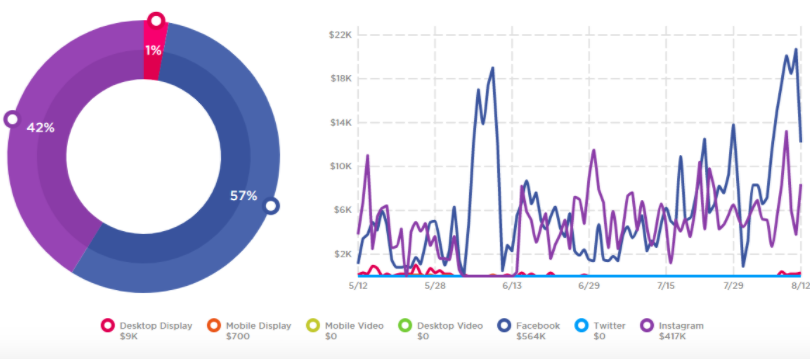

9) The Farmer’s Dog

- 90-day Facebook spending: $564,100 → 75,138,900 impressions

- 90-day Instagram spending: $417,400 → 62,312,900 impressions

- 90-day Twitter spending: No spend

90-day digital spending overview:

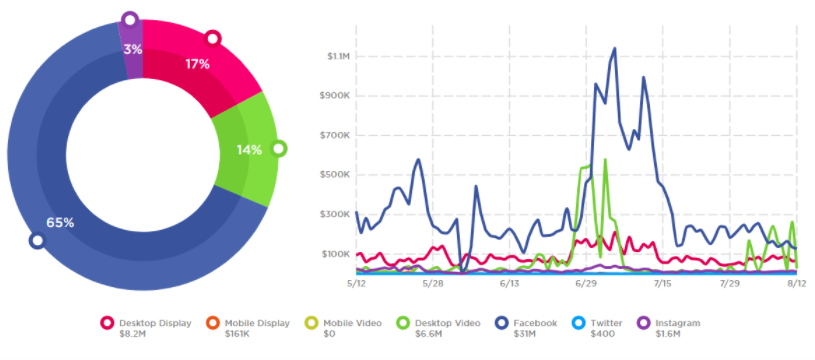

10) Purple

- 90-day Facebook spending: $30,977,400 → 4,126,705,700 impressions

- 90-day Instagram spending: $1,552,200 → 232,454,800 impressions

- 90-day Twitter spending: $400 → 105,900 impressions

90-day digital spending overview:

Interested in ad buying contacts for these brands? Want to explore other top advertisers spending on social? Request your trial of Winmo to uncover opportunities like these at scale here: