You don’t have to wait much longer for the 2023 NFL season to start. Next Thursday, Sept. 7, the Detroit Lions will play at the Kansas City Chiefs, followed by The San Francisco 49ers at the Pittsburgh Steelers over the weekend. If you’re looking at the matchups in terms of sponsorships, then that’s the Ford Motor Company vs. retailer Engelbert Strauss and United Airlines vs. Kraft Heinz. As these brands continue to invest their Q3 marketing budgets into NFL sponsorships, many of them (30+ in fact…) are also using this quarter to plan and execute their media buying strategies.

Media buying in Q3 (July to September) can offer several benefits to advertisers and marketers:

- Targeting parents and students for back-to-school season

- Promoting summer travel products and services

- Ensuring a strong presence during the busy holiday shopping season

- Building anticipation for year-end sales events like Black Friday and Cyber Monday

- Less competition compared to Q4

- And, for these 30+ NFL sponsors — targeting football fans and consumers while they’re highly engaged in a new season

Keep reading for additional executive, spending, and targeting insights for three NFL sponsors buying media in Q3 2023. And click the link above to download the full list.

1) Chick-fil-A launches initiative under newly promoted CMO

-

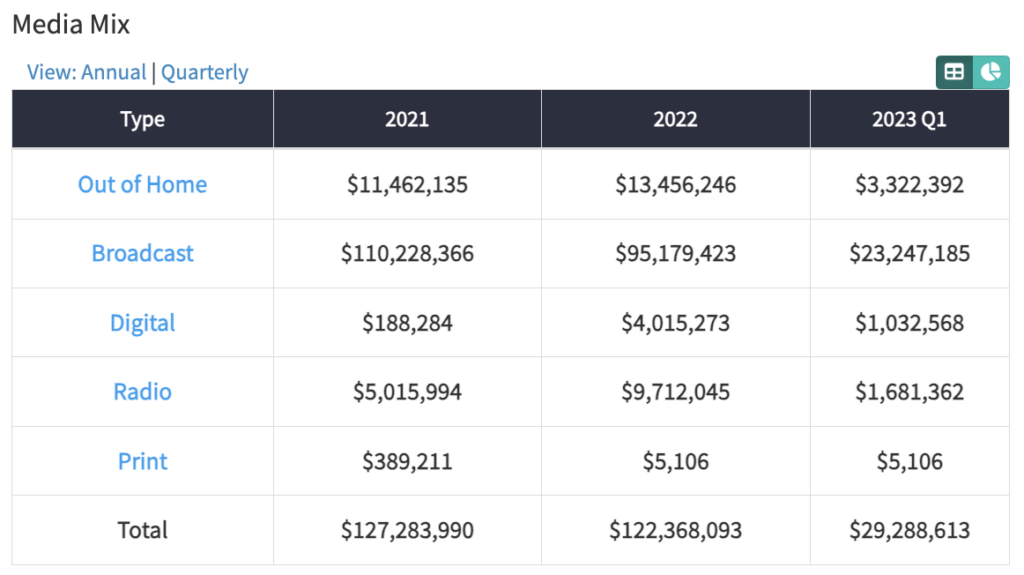

Estimated Media Spend: $122,368,093

-

Estimated Revenue: $4,051,000,000

Chick-Fil-A recently launched a campaign and a digital video game through which people can earn free food. The campaign — in partnership with agency partner Jackson Spalding — also includes a billboard in Times Square, a merch line dubbed the “Cow Collection,” and a national TV spot. This effort rolled out a few months after Chick-Fil-A named Maria Martinez as its CMO toward the beginning of 2023 (Martinez was most recently the company’s assistant manager).

Chick-Fil-A will likely:

- Continue shifting/digitizing its strategy

- Keep increasing digital spending

- Seek new agency partners

Spending insights:

- Broadcast insights (TV ad creative spend, effectiveness, impressions, and performance): So far this year, Chick-Fil-A has spent approximately $37.3m on national TV commercials, down 17% from the approximately $45m spent by this point last year. Chick-Fil-A’s 2023 commercials have aired during shows such as the 2020 NBA All-Star Game, ¡Despierta América!, the Allstate Sugar Bowl, Friends, and Chicago Fire.

- Digital and social insights (digital ad spend, effectiveness, impressions, and performance): The fast food chain has allocated roughly $31.7m toward digital ads YTD, almost double the roughly $16.4m allocated by this point last year. Since the beginning of 2023, CFA has earned about 3.7b digital impressions, 48% via YouTube ads, 39% via Facebook ads, and 13% via Instagram ads.

- Chick-Fil-A also invests in OOH, print (newspapers), radio, digital, local broadcast, Facebook, Instagram, and online video (via Youtube Android, Youtube IOS, and Youtube.com) ads.

Agency insights: The recent CMO promotion may lead to agency reviews, especially considering that Jackson Spalding seems to be a relatively new agency partner. Current agency roster:

- Jackson Spalding: PR agency partner

- In-House: Creative

- Starcom Worldwide: Media AOR

- McCann New York: Creative AOR

- BOLTGROUP: Creative agency partner

- Gallegos United: Multicultural agency partner

- Havas Sports & Entertainment: Social and experiential agency partner

- Publicis Media: Social agency partner

2) Southwest Airlines launches campaign with Wattpad

- Estimated Media Spend: $45,241,160

- Estimated Revenue: $15,790,000,000

Southwest Airlines just launched its inaugural brand film made with global creator community Tongal and web novel platform Wattpad. This is part of Southwest’s larger “On the Rise” brand platform, which originally kicked off in 2017 and expanded in 2021 through a collaboration with Wattpad.

Southwest will likely:

- Continue pursuing collaborations

- Keep rolling out work for this campaign

- Continue increasing spend

- Seek new agency partners amid a CMO search

Spending insights:

- Broadcast insights (TV ad creative spend, effectiveness, impressions, and performance): So far this year, Southwest has spent approximately $5.2m on national TV commercials, 27% more than the approximately $4.1m spent within the same 2022 timeframe. Southwest’s 2023 commercials have targeted Gen-X watching shows such as NBA Basketball, The Cosby Show, Family Guy, For My Man, and A Different World.

- Digital and social insights (digital ad spend, effectiveness, impressions, and performance): The company has allocated roughly $17.2m toward digital ads YTD, more than double the roughly $8.5m allocated by this point last year. Since the beginning of 2023, Southwest has earned ~2.5b digital impressions via Facebook (45%), Instagram (27%), Twitter (20%), YouTube (5%), desktop video (2%), and desktop display (1%) ads.

- The company utilizes local broadcast, digital, radio, print, OOH, Google Ads, Twitter, TikTok, Instagram, Facebook, and online video (via Youtube.com and Youtube IOS) ads.

- The company invests in short-form DRTV. It has rather high network TV coverage and will likely launch a new campaign within the next 30 days or so. Southwest’s top TV networks include USA and MLB.

Agency insights: If you haven’t yet done so, reach out soon to get on the radar of Ryan Green, whose role was expanded to chief commercial officer in October 2022. Southwest does not seem to have yet found a new CMO to succeed him. Current agency roster:

- Tongal: Agency partner (project-by-project since 2021)

- GSD&M: Creative AOR

- Spark Foundry: Media AOR

- RPA: Digital AOR

- Pan Up Productions: Creative agency partner

- Pace Communications: Digital agency partner

3) Uber adds car seat option through partnership with Nuna

- Estimated Media Spend: $142,009,378

- Estimated Revenue: $17,455,000,000

Uber teamed up with Nuna to offer a new riding option called Uber Car Seat for children weighing between 5-65 lbs and up to 6 years old. The pilot program is being tested in New York and Los Angeles and will roll the service out in other cities soon.

Uber will likely:

- Increase ad spend or launch a campaign to promote the new car seat option

- Try additional partnerships

- Review other accounts

Spending insights:

- Broadcast insights (TV ad creative spend, effectiveness, impressions, and performance): Uber spent nearly $4.3m on national TV ads YTD, a huge increase from $2.3k spent in this channel during the same time period in 2022. It placed ads during programming such as The Voice, Dateline NBC, Chicago Med, Chicago P.D., and Night Court.

- Digital and social insights (digital ad spend, effectiveness, impressions, and performance): Uber spent around $23.4m on digital display ads YTD, a 35% decrease from $36.2m spent in this channel during the same time period of 2022. It placed 100% of these ads directly onto youtube.com, instagram.com, facebook.com, twitter.com, and twitch.tv.

- Uber also invests in radio, OOH, print, and local broadcasts. It holds media planning discussions in Q4.

Agency analysis: There still may be time to get your pitches in and participate in the media review. Keep in mind, Uber may review its other accounts once it finds a new media AOR. Current roster:

- EssenceMediacom: Media AOR

- R/GA: Creative, digital, and social AOR

- Johannes Leonardo: Creative AOR